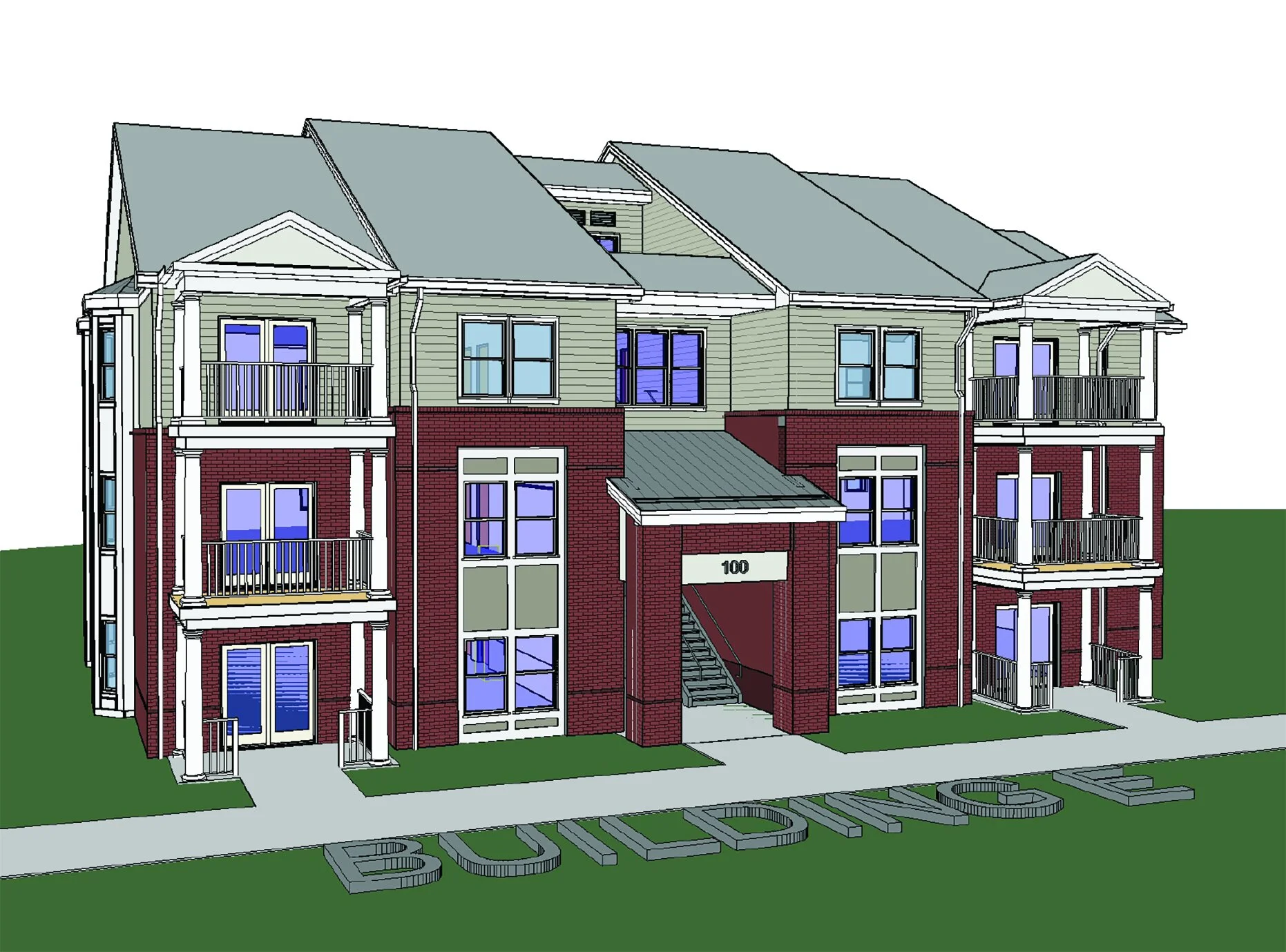

Marywood Apartments of Manassas

/AGM Financial Services, Inc. is excited to announce the successful closure of a $15,000,000 mortgage for the extensive renovation of Marywood Apartments, benefiting the residents for many years to come. This remarkable project will provide for $68,000/unit in rehabilitation to this 129-unit, age-restricted community with 100% Section-8 housing in Manassas, Virginia. The 40-year FHA insured loan was made using the Section 221(d)(4) program providing long term fixed rate construction/permanent debt. The four-story, elevator-served building includes extensive amenities such as a large multipurpose community room, fitness room, hair salon, library, impressive pottery studio, laundry room, and meeting spaces on every floor.