On April 30, 2021: FHFA hosted a public listening session to receive input and feedback on how small multifamily lenders, such as depository institutions, CDFIs, credit unions, and housing finance agencies, might gain access to Fannie Mae and Freddie Mac multifamily products.

Myles Perkins, President of AGM Financial Services, was a speaker and provided the following insights:

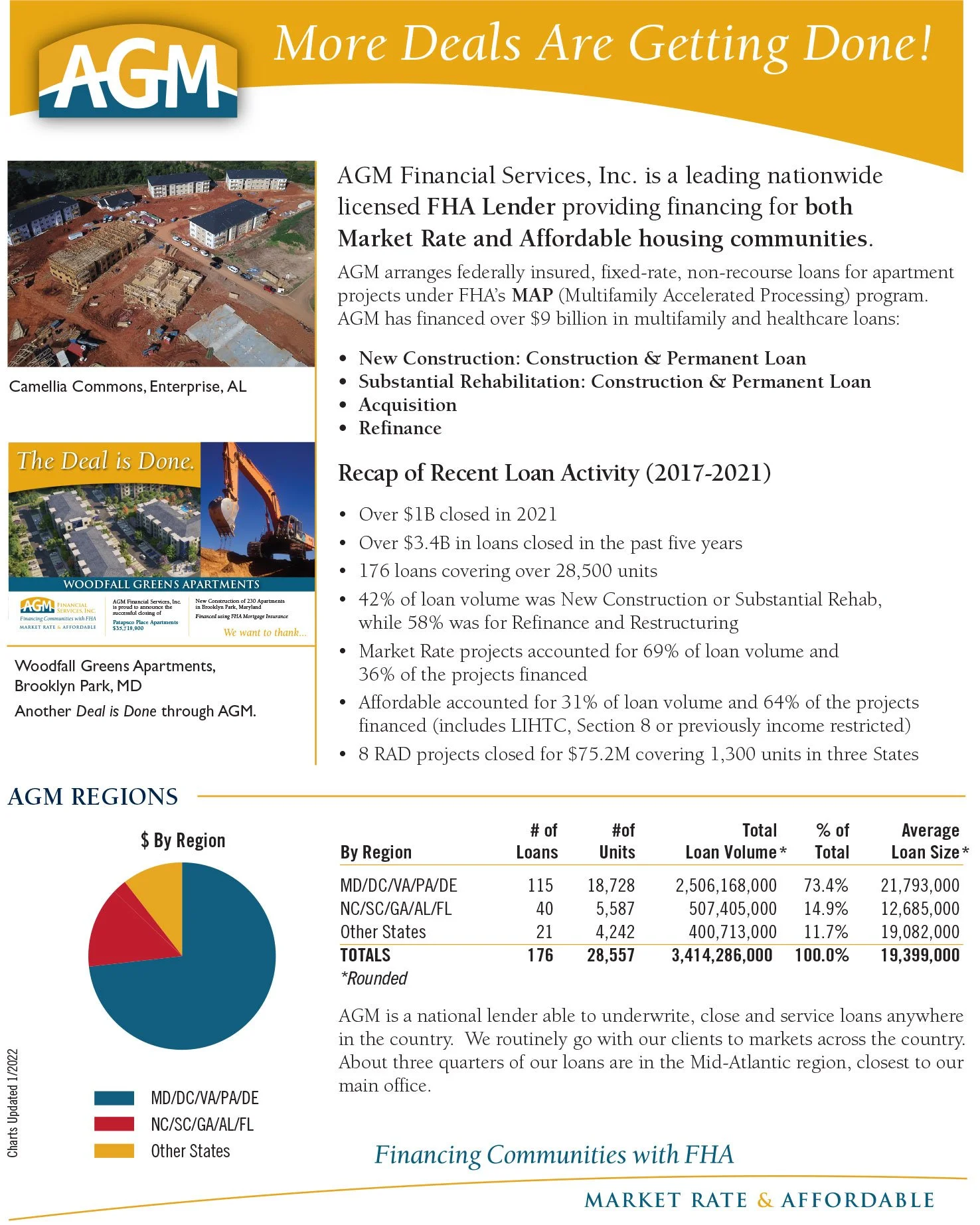

AGM is a privately held nonbank FHA multifamily lender based in Baltimore. We've financed more than $8 billion of FHA insured loans. We have 21 employees and have been in business for 30 years.

We're going to originate and close about $1 billion of financing this year, which will likely put us in the top ten for FHA lenders. But most of our competitors are larger financial institutions who also have GSE platforms. We've always been interested in obtaining access to the GSE programs, but whenever we’ve reached out to the GSE multifamily contacts, we haven't made much progress. And our understanding is that Fannie and Freddie have not been issuing new multifamily licenses, except on rare occasions in the last 10 to 15 years.

It's our hope that FHFA will issue direct guidance that Fannie and Freddie must serve with equal pricing qualified small lenders. The GSEs actively encourage and approve qualified small lenders in the single family space. If the FHFA does not issue new policy, small multifamily lenders will remain shut out from GSE access and execution.

Our clients range in scope and size, but we have a large number of nonprofit clients who focus on affordable housing. We've financed more than 30 RAD deals for housing authorities across the country, and more than 40 4% LIHTC projects in Maryland alone. And when I say LIHTC, I mean Low Income Housing Tax Credits, I want to be clear with the audience.

While we have many large, sophisticated clients, we also have smaller clients who fly under the radar of larger financial institutions. The FHA product is an excellent program, but it can often take six to nine months or longer to obtain a commitment or rate lock. Fannie and Freddie executions can often be done and closed in 90 days or less.

The capital markets have been extremely volatile for the last 15 years. Rates can move dramatically. And the uncertainty of timing execution with FHA is very difficult on projects that are affordable, and often debt service constrained. A spike in rates could easily reduce loan proceeds, which are often needed to inject capital into apartments.

To get a sense of what I mean by affordable, the most common type of low income housing tax credit deals are designed for residents who are making 60% of area median income. In Baltimore, the income at 60% AMI for one person is $42,000 a year. And the maximum rent for that person in a LIHTC project is $1,060 inclusive of utilities. And $990 exclusive of utilities.

So anyone who's familiar with kind of the northeast and Baltimore can see it serves people who are working, but at the lower income scale, and who need access to quality affordable housing at reasonable rents. This reduced type of rent level isn't possible without the subsidy from the LIHTC because these rents wouldn't support the costs of construction for new apartments.

For FHA, we have a refinance program called a 223-F, which is a 35 year fully amortizing fixed rate mortgage. It's a nice product, but it doesn't fit all transactions and isn't that flexible. Whereas, Fannie and Freddie can offer five, seven, ten, 12 year terms, often fixed or floating, sometimes as interest only periods.

For affordable housing projects, that flexibility allows the borrower to maximize the plan that benefits the residents the most. We see the need for affordable housing in all the markets that we’re active. And the ability to offer GSE debt would mean that owners can move more quickly, invest more capital and preserve more affordable housing.

I think on the surface, it's hard sometimes to see the direct connection to the resident. But the way a project is financed has tangible effects on the ability to put LIHTC place, make repairs, and provide quality home for residents.

I think that's really the key here is that we're local, we're in small markets, and we have smaller clients who aren't often serviced by larger financial institutions who are focused on larger projects, larger clients, larger sponsors. And so I think having additional access to the GSEs for smaller lenders would enable more capital to flow to smaller, affordable nonprofit projects, which directly impact residents.

To learn more about your options with FHA then contact AGM’s Origination Team.