The Davis-Bacon Act requires laborers and mechanics employed on FHA-insured housing projects to be paid wages at rates not less than those prevailing in the local market, as determined by the Department of Labor (DOL). When considering FHA-insured financing for new construction or substantial rehab projects, multifamily developers often express concern about the impact of Davis-Bacon wage rates on construction costs. However, our analysis shows that Davis-Bacon requirements have little, if any, impact on construction costs for residential projects in right-to-work states.

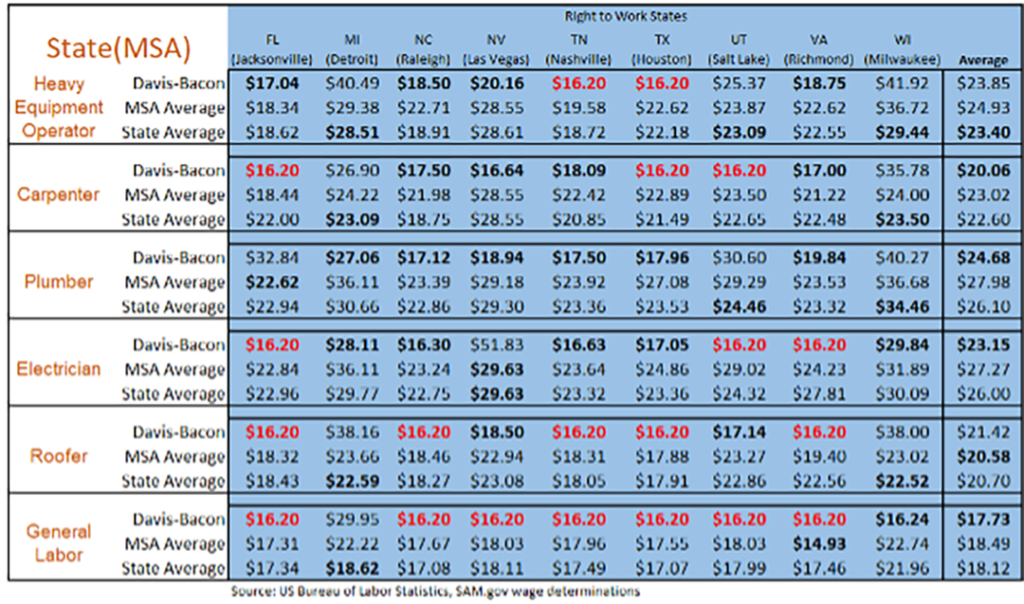

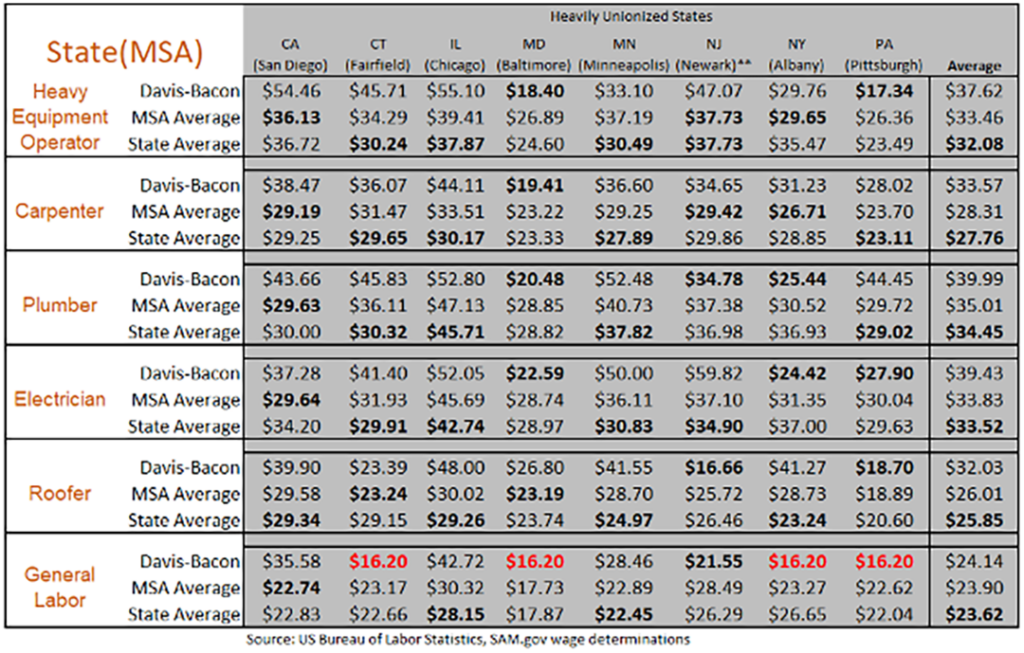

While looking at the impact of Davis-Bacon residential wage rates on project costs in heavily unionized and right-to-work states, we gathered information on both Davis-Bacon wage rates and average market wages as reported by the DOL’s Bureau of Labor Statistics for seventeen MSAs around the country. We selected the MSAs based on size and the availability of wage data to gather a representative sample.

For the purpose of this research, we looked at wage data for six trades associated with multifamily construction – heavy equipment operator, carpenter, plumber, electrician, roofer, and general laborer. In right-to-work states, Davis-Bacon hourly wages are lower than reported MSA or state hourly wages for all but two of the occupations – heavy equipment operator and roofer. By comparison, Davis-Bacon hourly wages are well above the reported MSA and state average wages for the listed occupations in heavily unionized states.

The numbers in bold are the lowest of the three wage rates reported (Davis-Bacon, MSA average, and state average) for that occupation in the MSA. The numbers in red are minimum rates set nationally by Executive Order 14026 and serve as a minimum Davis-Bacon wage rate for that occupation.

The results are presented in the tables below.

Data from Clark County, Nevada, offers a case in point. Nevada is a right-to-work state, and Clark County, including Las Vegas, is its largest MSA. In Clark County, Davis-Bacon wages for five of the six occupations studied – heavy equipment operator, carpenter, plumber, roofer, and general labor – are lower than reported average hourly wages in the market and the state. Only one – the wage rate for an electrician – is significantly higher than the reported MSA and the state averages.

In right-to-work states, the Davis-Bacon wage requirements would appear to serve only as a floor for hourly wages on FHA-insured multifamily projects for the six trades studied. In those states, Davis-Bacon wages are, on average, 8.5% lower for the occupations studied. However, if we remove Detroit and Milwaukee (both heavily unionized markets in right-to-work states) from the calculation, Davis-Bacon wages are on average, 23.6% lower than the reported market wages.

The twenty-eight states and territories considered right-to-work include:

Alabama

Arizona

Arkansas

Florida

Georgia

Idaho

Indiana

Iowa

Kansas

Kentucky

Louisiana

Michigan

Mississippi

Nebraska

Nevada

North Carolina

North Dakota

Oklahoma

South Carolina

South Dakota

Tennessee

Texas

Utah

Virginia

West Virginia

Wisconsin

Wyoming

Guam

Based on the data collected, Davis-Bacon wages are no higher than market wages in right-to-work states. Therefore, there would be no adverse effect on project costs for FHA-insured residential construction in these areas.

About AGM Financial

Founded in 1990, AGM is a leading FHA lender and GNMA seller/servicer. From new construction and substantial rehab to acquisition or refinance — for both market-rate and affordable projects — AGM gets the deal done. Family-owned with over 30 years of experience, the firm has closed over $9 billion in FHA-insured multifamily project loans nationwide. We underwrite, fund, and service all of our loans. Developers and owners can count on AGM to be accessible, transparent, consistent, and ready to lend. From new construction to substantial rehabilitation to acquisition and refinance — for both market-rate and affordable projects — we can get the deal done. To learn more about AGM, call 800.729.4266 or visit www.agmfinancial.com.