FHA Proposals on New MIP Premiums and Eliminating Green MIP

Late yesterday, HUD announced important proposed changes in mortgage insurance premiums (MIP) for FHA-insured multifamily loans. In a notice to be published in the Federal

FHA-insured financing to acquire or refinance affordable multifamily projects offers fixed rates, higher leverage, and longer amortization. It works very well with LIHTC and soft debt.

FHA-insured financing for acquisition or refinance is available with:

Affordable projects can take advantage of more favorable FHA underwriting.

Debt service coverage and loan-to-value vary depending on the affordability of the project. Properties with project-based Section 8 get the highest LTVs and the lowest coverage, while LIHTC projects are underwritten depending on their rent advantage versus market. All FHA-insured loans for acquisition or refinance are fully amortizing with a 35-year term, and loan proceeds can be used for moderate rehab, typically up to about $54,000 per unit.

Interest rates on FHA-insured loans are fixed just before closing and remain fixed for the life of the loan. FHA-insured loans are fully assumable and prepayable at any time, subject to declining prepayment penalties.

Late yesterday, HUD announced important proposed changes in mortgage insurance premiums (MIP) for FHA-insured multifamily loans. In a notice to be published in the Federal

Last week, the National Association of Home Builders held its Spring Legislative Conference and Leadership Meetings in Washington, DC. The Legislative Conference saw more than

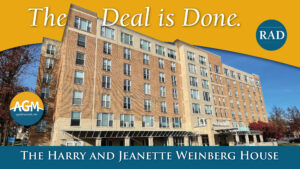

AGM Financial Services, Inc. is proud to announce the successful closing of a $6,460,000 mortgage for the substantial rehabilitation of “The Harry and Jeanette Weinberg

20 South Charles Street

Suite 1000

Baltimore, MD 21201

Phone: 410.727.2111

Toll-Free: 800.729.4266

© 2025, AGM Financial Services