FHA Proposals on New MIP Premiums and Eliminating Green MIP

Late yesterday, HUD announced important proposed changes in mortgage insurance premiums (MIP) for FHA-insured multifamily loans. In a notice to be published in the Federal

For multifamily projects that need to get underway quickly and can get a conventional construction loan, refinancing the completed project with an FHA-insured takeout can be a great option.

An FHA-insured refinance for multifamily offers fixed rates, higher leverage, and longer amortization, all nonrecourse, with no limits on rents, tenants, or returns.

FHA-insured financing* is available at the lesser of:

*Up to $130 million

FHA-insured loans for refinancing are fully amortized with a 35-year term.

Interest rates on FHA-insured loans are fixed just before closing and remain fixed for the life of the loan. Loans are fully non-recourse, subject only to certain “carve-outs” such as fraud, theft of funds, or unapproved transfers of ownership.

Late yesterday, HUD announced important proposed changes in mortgage insurance premiums (MIP) for FHA-insured multifamily loans. In a notice to be published in the Federal

Last week, the National Association of Home Builders held its Spring Legislative Conference and Leadership Meetings in Washington, DC. The Legislative Conference saw more than

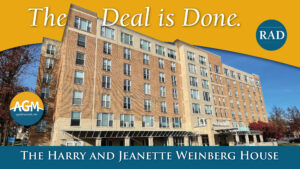

AGM Financial Services, Inc. is proud to announce the successful closing of a $6,460,000 mortgage for the substantial rehabilitation of “The Harry and Jeanette Weinberg

20 South Charles Street

Suite 1000

Baltimore, MD 21201

Phone: 410.727.2111

Toll-Free: 800.729.4266

© 2025, AGM Financial Services