The recent headline on GlobeSt.com was “Apartment Construction Reaches a 10-Year Low.” According to data first published by RealPage, at the end of the second quarter, there were just over 542,800 multifamily units under construction, down from 1.1 million two years ago. No surprise there.

The drop in starts and units under construction has been widely reported, as have the causes of the decline. Higher costs, higher interest rates, and the addition of thousands of new units in markets across the country have all contributed to the slowdown.

What hasn’t been as widely reported is absorption.

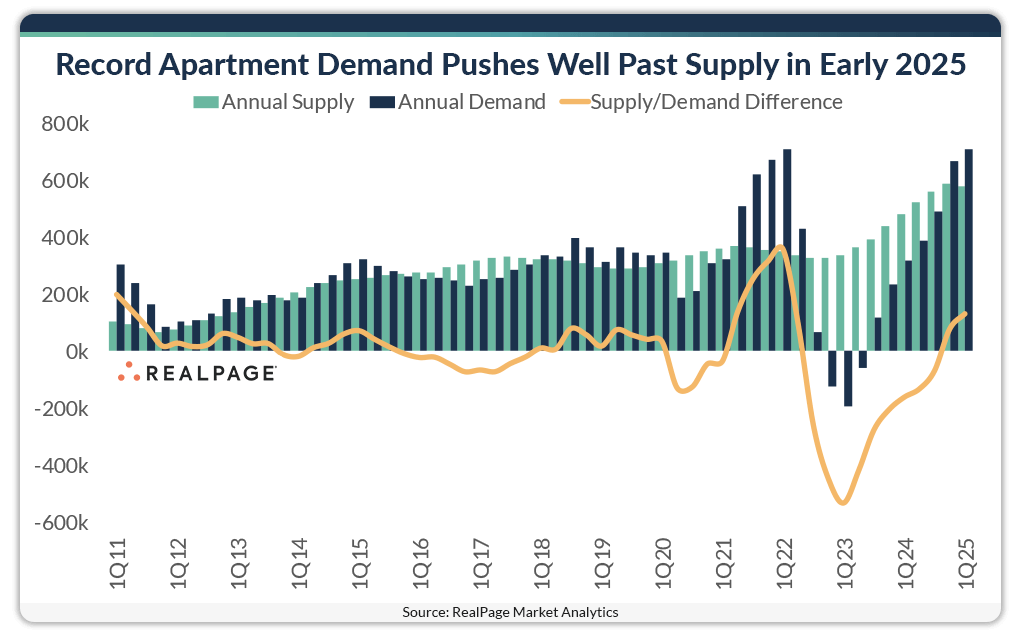

Again, according to RealPage, the U.S. apartment market is absorbing over three times more units than developers are starting right now. In the first quarter of this year, just over 209,000 market-rate units went under construction, while demand reached a record high of nearly 708,000 units in the same quarter. That means that 3.4 times more units were rented than were started in the last year, the highest ratio of absorption to starts since 2010.

Build Into the Gap

Higher mortgage rates and rising home prices mean that renting remains more affordable than buying in many markets nationwide. The lower cost of renting vs. owning, fewer multifamily starts, and strong absorption all point to higher rents in 2025. Most experts see rent growth of 2.2% for the year, still 60 bps lower than the 2000-to-2023 average of 2.8%, but much stronger than we have seen in the past two years.

With fewer starts, strong absorption, rising rents – and the prospect of lower rates before year’s end – now is the time to plan new multifamily projects.

That’s where AGM Financial Services comes in — delivering the capital, expertise, and certainty to turn opportunity into groundbreakings.

If you have questions or would like to discuss how FHA financing can help get your next development project started, please schedule a call.

About AGM Financial

Founded in 1990, AGM is a leading FHA lender and GNMA seller/servicer. From new construction and substantial rehab to acquisition or refinance — for both market-rate and affordable projects — AGM gets the deal done. Family-owned with over 30 years of experience, the firm has closed over $10 billion in FHA-insured multifamily project loans nationwide. We underwrite, fund, and service all of our loans. Developers and owners can count on AGM to be accessible, transparent, consistent, and ready to lend. From new construction to substantial rehabilitation to acquisition and refinance — for both market-rate and affordable projects — we can get the deal done. To learn more about AGM, call 800.729.4266 or visit agmfinancial.com.