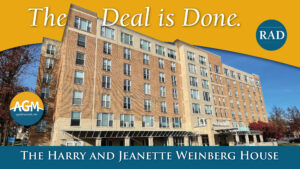

The Harry and Jeanette Weinberg House in Pikesville, MD

AGM Financial Services, Inc. is proud to announce the successful closing of a $6,460,000 mortgage for the substantial rehabilitation of “The Harry and Jeanette Weinberg

AGM Financial Services, Inc. is proud to announce the successful closing of a $6,460,000 mortgage for the substantial rehabilitation of “The Harry and Jeanette Weinberg

We want to thank everyone who made this closing a success: Borrower: 4710 Park Heights Senior Limited Partnership Developer: NHP Foundation Co-Sponsors/developer: The Henson Development

The way to catch a knuckleball is to wait until it stops rolling and then pick it up. – Bob Uecker In baseball, the knuckleball

In the past few weeks, the multifamily industry has seen a flood of rumors – program revisions, regulatory rollbacks, funding cuts, and changes at HUD.

The change in Administration brought with it a flood of news about agency closings, furloughs, buyouts, and the like. It’s been tough to keep up.

AGM Financial Services, Inc. is proud to announce the successful closing of a $14,450,500 Section 221(d)(4) mortgage for this 100 unit new construction project. The

Long-term rates have been rising since their recent lows in September. The bond market is reacting to uncertainty – uncertainty about inflation, jobs, tariffs, tax

For the fourth consecutive year, AGM Financial Services (AGM) donated a total of $100,000 to four Baltimore nonprofit organizations. Recipients will receive a $25,000 unrestricted grant that

In November, we told you about two proposed changes to FHA underwriting meant to increase multifamily production. Now it’s official. Late yesterday, HUD announced changes

AGM Financial Services, Inc. is excited to announce the successful closure of a $47,233,300 mortgage for the new construction of “The Depot at North Salem.” This

The 2024 election is over, and whatever you think of the outcome, things feel pretty uncertain just at the moment. We have all been holding

AGM Financial Services, Inc. is proud to announce the successful closing of a $44,278,400 construction-permanent loan for the development of West Catawba Apartments located in